(Woodland, CA) – (January 17, 2020) – It’s Tax Time and the Yolo County District Attorney is warning the community to be alert for fraudulent emails from someone claiming to be from the Internal Revenue Service.

By now, many are well aware of the IRS phone scam in which a supposed “IRS employee” threatens the victim with immediate arrest if a payment is not made to settle their non-existent tax debt. However, much like a virus, the scams mutate and are updated as they become less effective. Now criminals have started the next scam commonly known as the “tax transcript” scam.

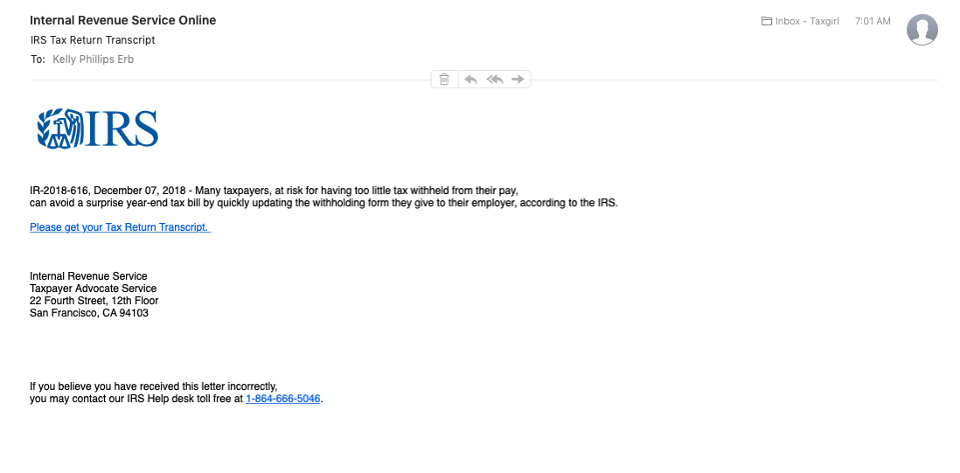

In this latest attempt to separate you from your money, the scammers pretend to be from “IRS ONLINE” in an email fraud campaign. There is usually an attachment with some variation of “tax transcript” or similar with instructions to open the attachment for important information. When the unsuspecting recipient opens the attachment, a well know malware (EMOTET) is unleashed on your computer. EMOTET has been associated with other bank and other financial institution phishing efforts, but recently morphed into an IRS scam.

The IRS is so concerned they issued a statement reminding taxpayers that it does not send unsolicited emails to taxpayers, nor would it email a tax transcript containing sensitive taxpayer information. The information is available through the secure IRS online website, but this is different than regular email.

The IRS suggests deleting the email or if you are comfortable doing so, forward the scam email to phishing@irs.gov. The IRS monitors the latest scams in an effort to get ahead of the fraudsters.

In no circumstances should you ever open such an attachment or enter or provide sensitive personal data to any unsolicited email. As with so many of these scams, criminals often try to catch people off guard or scare them so they respond and provide personal information like a social security number, credit card, or bank account number, before realizing it’s a scam.

District Attorney Jeff Reisig says you cannot be too careful, “If you receive an unexpected email like this, never open the attachments or provide any personal information and please ask a trusted friend or advisor for assistance verifying the request,” said Reisig. “There really isn’t anything that can’t wait while you check it out.”

If you receive these suspicious emails please contact the Yolo County District Attorney’s Fraud Hotline at 1-855-4-YOLO-DA or your local law enforcement agency. Reports of suspected fraud can also be made online at https://www.yoloda.org or by email to fraud@yoloda.org.

###